Image Credit: Postcard of a Beaumont Oil Gusher, Date Unknown; texashistory.unt.edu/ark:/67531/metapth563118/: accessed October 11, 2018), University of North Texas Libraries, The Portal to Texas History, texashistory.unt.edu ; McFaddin-Ward House Museum

Research is defined as the systematic investigation and study of materials in order to establish facts and reach new conclusions. It can be implied, then, that there will always be new discoveries, some of which even challenge or replace the old. AREC Research Professor Stephen Salant, with the help of colleagues Soren T. Anderson and Ryan Kellogg, has recently written a paper that reformulates Harold Hotelling’s theory of exhaustible resources (1931) when applied to resources under pressure like oil. The scholarly article, Hotelling Under Pressure, was published in the Journal of Political Economy in June, and shows that oil production from existing wells in Texas does not respond to oil prices, while drilling activity and costs respond strongly. The research shows that, in response to a steady oil price, the path of oil drilling declines over time and production rises to a peak before falling, contrary to what the old model predicts but consistent with observed production in every state analyzed.

To predict how an economic policy will affect global warming, policy makers must forecast how that policy will affect the future production of oil, a major source of carbon emissions. Economists base forecasts of oil production on a model proposed three quarters of a century ago by Harold Hotelling. Few models in economics have endured unchallenged as long as Harold Hotelling’s theory of exhaustible resources. Published in 1931 in the prestigious Journal of Political Economy (JPE), the theory has been extended by countless economists including at least 5 Nobel Laureates. Hotelling’s article was brilliantly exposited by Nobel Laureate Robert Solow in his 1972 Presidential address to the American Economic Association. More recently, Gérard Gaudet surveyed the literature which Hotelling’s article has stimulated in his 2007 Presidential address to the Canadian Economics Association.

This summer, my two coauthors and I published in that same Journal of Political Economy “Hotelling under Pressure,” an article which we hope will supplant the Hotelling model when it is applied to exhaustible resources like oil which are propelled to the surface by underground pressure rather than lifted to the surface of a mine like gold.

Our model shares with Hotelling’s all but one assumption. Like him, we assume that the resource is in finite supply, that extraction over time is controlled either by a foresighted social planner or by a market of foresighted agents each of whom takes prices at any time as unaffected by his actions.

We depart from Hotelling, however, in our assumption about how oil is produced. Hotelling assumed that oil is “mined.” In any time period, taking more oil out of the ground increases extraction costs. This is a plausible assumption for resources like gold; but for resources like oil which are driven toward the surface by underground pressure this assumption is inappropriate. Hotelling’s assumption is often referred to as “cake eating.” There is a cake of finite size. The agent decides how much to eat in each period. Eating more in a period incurs a larger cost. There is no mention of oil drilling in Hotelling’s account because it is irrelevant to his account of oil production.

Our view of oil production is very different and was shaped by the experiences of Ryan Kellogg, a coauthor who worked for British Petroleum (BP) prior to his graduate training in economics. We view the oil stock as distributed in a finite collection of underground pools of oil. To access a pool, an extractor must drill a well, which requires him to incur the cost of renting a drilling rig. Since there is a competitive market for drilling rigs, the cost of renting a rig for a day equals the marginal cost of providing a day’s worth of drilling services. The marginal cost of providing drilling services depends on how many other rigs are simultaneously being rented since, if many are being rented, rigs must be brought from further away and the rig rental rate is then higher. Once a well is drilled, oil spurts out of the ground, propelled both the gas dissolved in it and the weight of oil pressing down from above (much as the weight of the water in a toilet tank forces water up into the toilet bowl). The oil flows out fast initially but the rate declines exponentially unless the extractor retards the flow or caps the well, preserving the underground pressure for later use. Instead of deciding how much of the finite-sized cake to eat over time, it is as if the agent decides how many of a finite collection of shaken soda cans to pop each period and whether to let the flow from each decline over time exponentially or whether to put his thumbs (multiple thumbs!) over the holes of some to retard the flow of soda and preserve the pressure for later release.

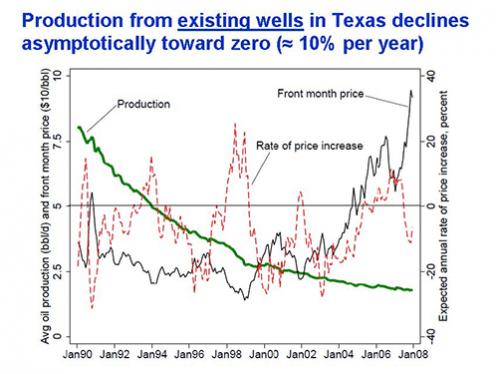

Many economists before us had used sophisticated econometrics to estimate the Hotelling model and then to show that its predictions about the oil price were deficient. We examine instead production from previously drilled wells. In that case, the inaccuracy of the predictions is immediately obvious to the naked eye. Hotelling’s model predicts that production---including production from previously drilled wells---should be very sensitive to changes in the current spot price and its rate of increase. As we show in Figure 1, however, production from existing wells in Texas between 1990 and 2008 is almost completely insensitive to sharp changes in these factors. Instead, consistent with our predictions, production from existing wells declined exponentially (at roughly 10% per year) over the life of the well.

Figure 1. Production from existing wells in Texas declines asymptotically toward zero (≈10% a year). Source: Hotelling Under Pressure.

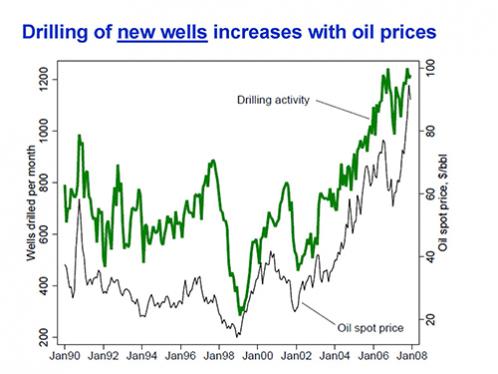

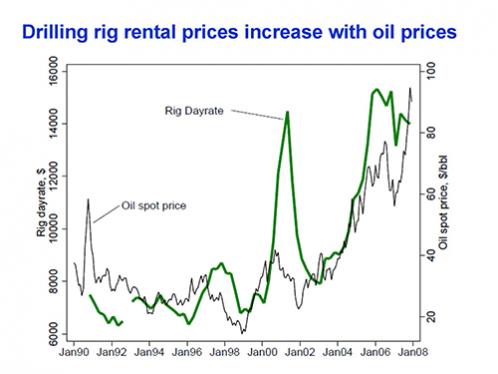

On the other hand, drilling activity (the number of wells drilled per month) and the daily rental price of a drilling rig (the Rig Dayrate) in Texas over the same time period are both positively correlated with the spot price of oil. Again, this is consistent with our model. Hotelling’s model makes no mention of drilling activity or the rental rate on drilling rigs.

Figure 2. Drilling of new wells increases with oil prices. Source: Hotelling Under Pressure.

Figure 3. Drilling rig rental prices increase with oil prices. Source: Hotelling Under Pressure.

Our predictions about production differ from Hotelling’s predictions because our assumptions differ from his. But since the technical arguments used to analyze our model follow exactly the same logic as Hotelling used, they will be second-nature to any student of the Hotelling model.

To take the simplest example, suppose the price of oil is anticipated to remain constant into the foreseeable future and the marginal cost of extraction increases when more oil is extracted in a period. Hotelling predicts that every price-taking extractor will decrease production smoothly over time until his finite reserves (his “cake”) are exhausted.

If the marginal cost per day of providing drilling services increases when more rigs are rented, we predict, using logic similar to Hotelling’s, that an extractor facing the same constant price will decrease drilling smoothly over time until he has exhausted his finite stock of undrilled oil wells.

What does this imply about production? Since the production flow declines exponentially once a well is drilled, we can deduce the path of production from the predicted path of drilling. We predict that production will rise, reach a peak, and then fall.

What accounts for our prediction? Oil production in any period (1) increases because of the addition of newly drilled wells but (2) decreases because of the decline of previously drilled wells. When oil is first drilled, there are no previously drilled wells, so production is small but grows as new wells are drilled. As the number of previously drilled wells increases and the drilling of new wells decreases, there comes a point where aggregate production reaches a peak and then begins to decline. Once there are no wells left to drill (no more soda cans to pop open), production declines exponentially toward zero.

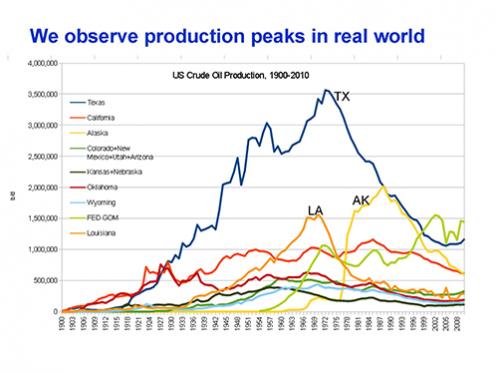

As Figure 4 documents for selected states, U.S. oil production between 1900 and 2010 in each state does not steadily decline as Hotelling predicts but instead follows the qualitative pattern predicted by our model.

Figure 4. We observe production peaks in real world. Source: Hotelling Under Pressure.

Our article also makes predictions about future oil prices and extends the model to take account of the fracking revolution. But to understand these extensions, you will have to read the paper.

Hotelling under Pressure

Soren T. Anderson, Ryan Kellogg, and Stephen W. Salant

Journal of Political Economy 2018 126:3, 984-1026

https://doi.org/10.1086/697203